The 21st century has witnessed a great shift in the commerce industry globally, where traditional shopping is almost replaced with online shopping. It is barely found companies, whatsoever fields, doing their business in the form of brick-and-mortar stores only.

Like many other developing countries, Viet Nam is deemed as a gold mine for e-commerce business, where there are about 68 million internet users and more than a half of them, around 46 million people specifically, purchases consumer goods online in 2020. Approximately 6 billion USD has been generated from 2019 to the end of 2020 from the consumer goods market through e-shopping separately speaking. These numbers are expected to keep growing sharply in the future when the number of overseas e-commerce companies choosing Viet Nam to invest in is increasingly high.

At the present, a foreign company is able to provide e-commerce services in the territory of Viet Nam without a commercial presence required there. Regardless of this, the company is subject to foreign contractor tax regulations (also known as “withholding taxes”), which include the value-added tax (VAT) and the corporate income tax (CIT), if it runs the business or has income generated in the territory of Viet Nam on the basis of contracts made with Vietnamese organizations or individuals. Depending on specific types of goods and services, the e-commerce company may be subject to the excise tax.

Nevertheless, methods for the withholding tax calculation shall be varied upon the existence of a commercial presence in Viet Nam, namely:

(i) Paying the VAT using the credit-invoice method and paying the CIT according to declared revenue and expense (hereinafter referred to as declaration method).

(ii) Paying the VAT and CIT according to fixed rates (hereinafter referred to as the direct method).

(iii) Paying VAT using the credit-invoice method and paying CIT according to fixed rates (hereinafter referred to as the mixed method).

The regulations on these methods are as following sections.

1. Declaration method

Pursuant to the guidance of the Ministry of Finance (“MOF”), the declaration method is applied where:

(i) An e-commerce company has a permanent establishment in Viet Nam;

(ii) The period of business operation in Viet Nam under the contract is 183 days or longer from the effective date of the contract; and

(iii) The company applies Viet Nam’s accounting practice, has applied for tax registration and issued with a taxpayer ID number (TIN) by a tax authority.

Overall, this is to say that the e-commerce company must establish a legal entity in Viet Nam to apply this method because a branch is no issued a TIN and a representative office is unable to operate the business as stipulated in Vietnamese laws.

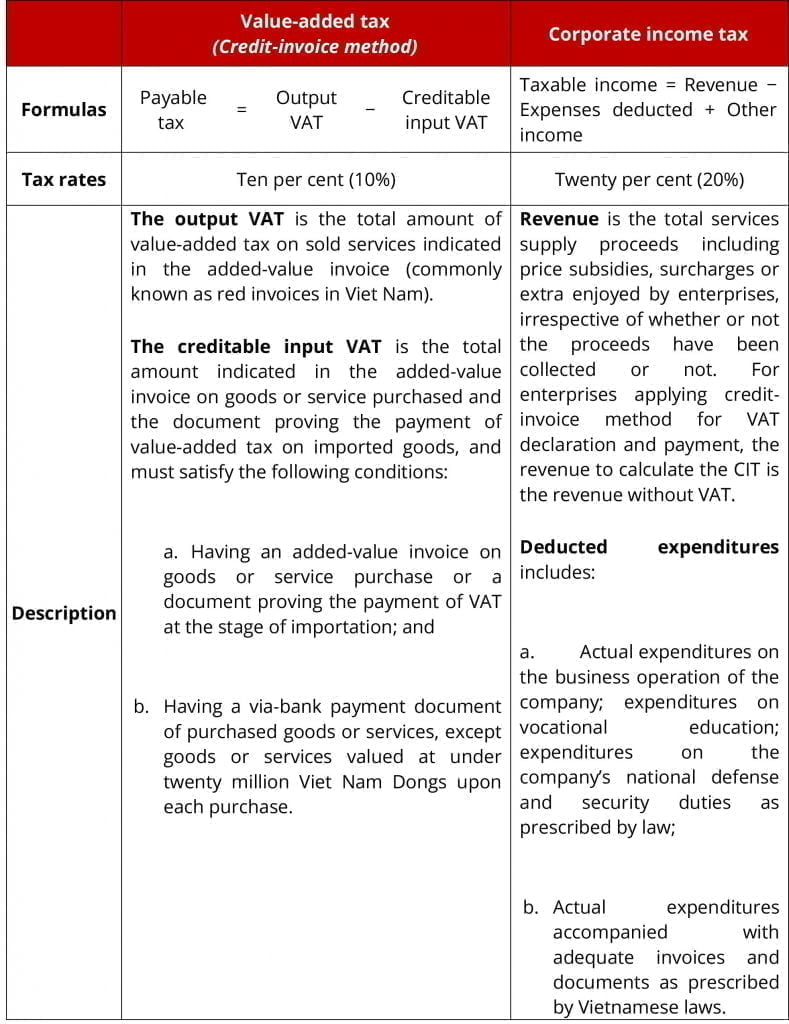

The table below briefly presents some noteworthy regulations on the declaration method.

2. Direct method

The direct method is applied where an e-commerce company does not meet one of the three conditions mentioned above, meaning that the company does not base in Viet Nam. If it is the case, the Vietnamese contractual parties who enter into contracts with the company shall be the ones who declare and pay the tax on behalf of the company. Such contractual parties could be end consumers (contracts under B2C form) or partners of the company (contracts under B2B form). This, in practice, would be quite difficult under the circumstance the Vietnamese contractual parties are individuals, regardless of they are end consumers or partners since the procedure of tax declaration and deduction is quite complicated and time-consuming.

Also, if the Vietnamese contractual parties are partners under B2B contracts, VAT and personal income tax of such partners shall not be directly declared by themselves. The company shall declare VAT on the whole revenue that is the result of the business cooperation regardless of how the revenue is distributed between the parties, and declare and pay personal income tax on behalf of its partners. Therefore, the foreign e-commerce company must have a commercial presence in Viet Nam to comply with this rule. Otherwise, the partners entering into contracts with the company are likely to be subject to tax arrears and administrative sanctions for tax evasion.

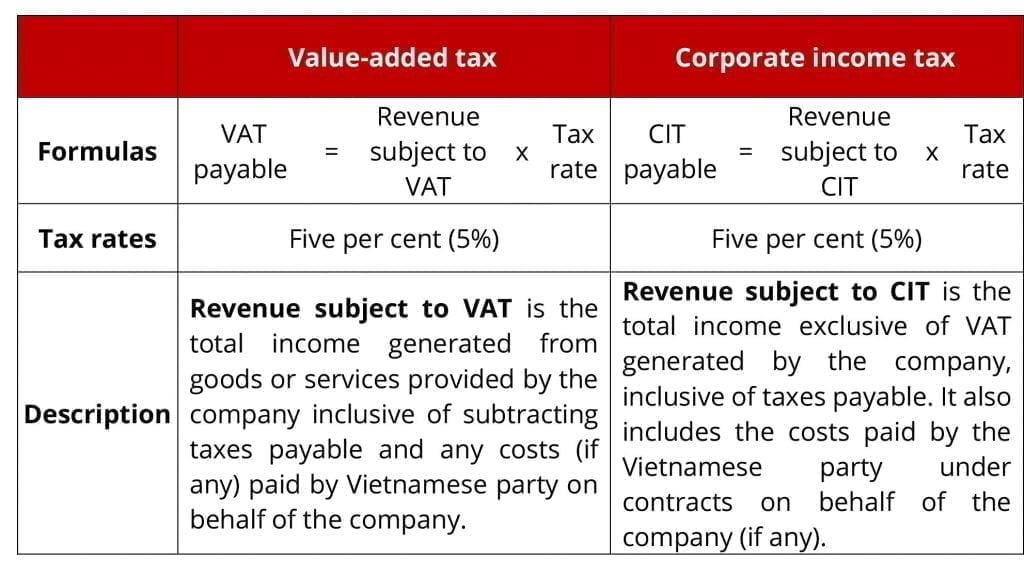

The table below presents some notes in relation to calculating VAT and CIT on the basis direct method:

3. Mixed method

This method is the combination of the two aforementioned methods. Accordingly, the foreign e-commerce company shall register with tax authority to pay VAT using credit-invoice method and pay CIT according to fixed rates. The conditions to apply this method are:

(i) The company has a permanent establishment in Viet Nam; and

(ii) The period of the business operation in Viet Nam under the contract is 183 days or longer from the effective date of the contract.

In summary, the second method seemingly brings an advantage to a foreign e-commerce company regarding taxation because of low tax rates and not being subject to tax declaration and payment obligations. It is, however, expected will be changed sooner in the direction that requires a foreign e-commerce company to establish a commercial presence in Viet Nam to control its tax obligations more strictly.

If you have any questions or require any additional information, please contact Apolat Legal – An International Law Firm in Viet Nam.

This article is for general information only and is not a substitute for legal advice.