In addition to the issues of labor contract, residence or non-resident and social insurance of the Head of Representative Office, Foreign Traders are also particularly interested in personal income tax issues of the Head of the representative office.

See more: Legal Issues Related To The Head Of The Representative Office Of Foreign Traders In Vietnam (Part 1)

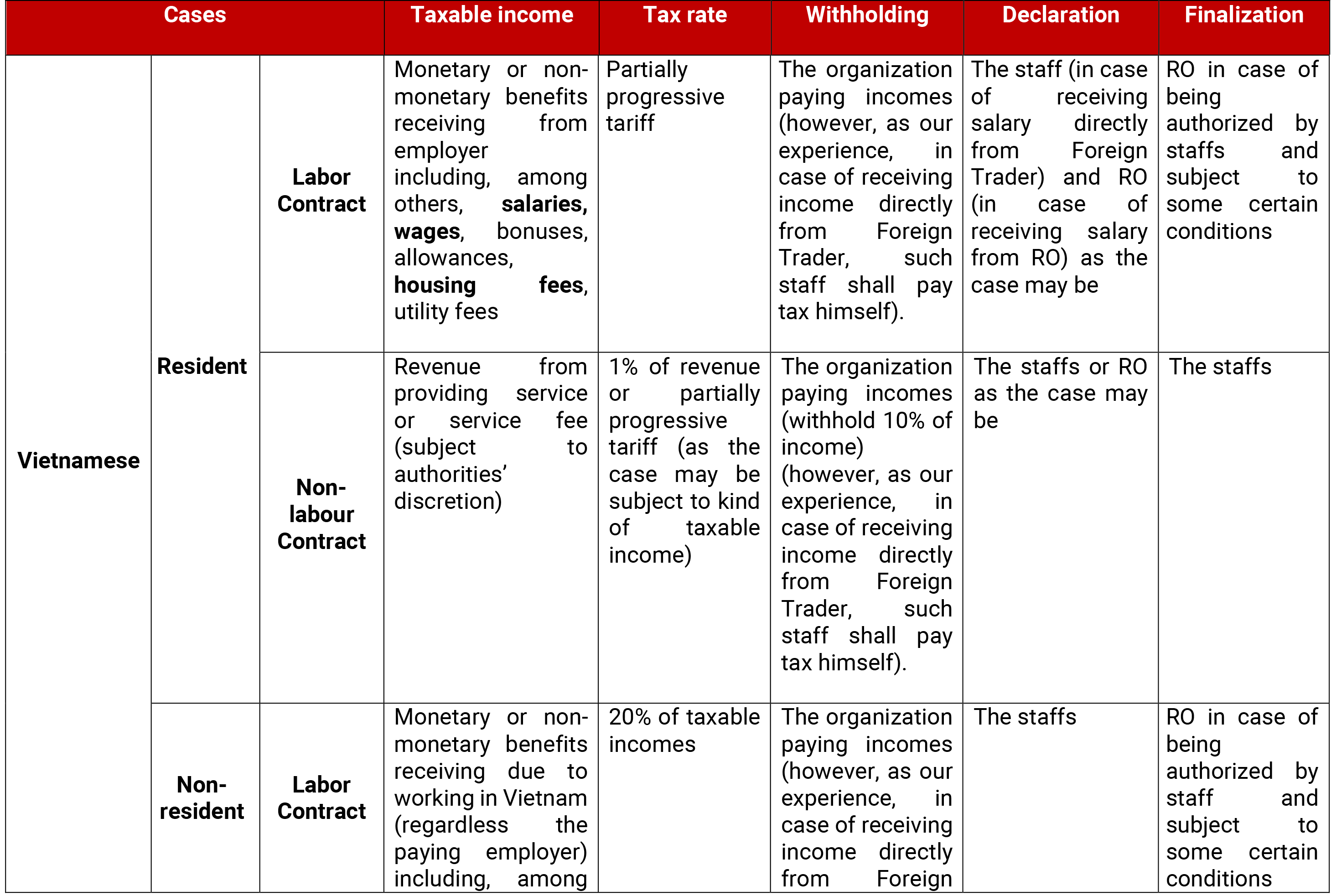

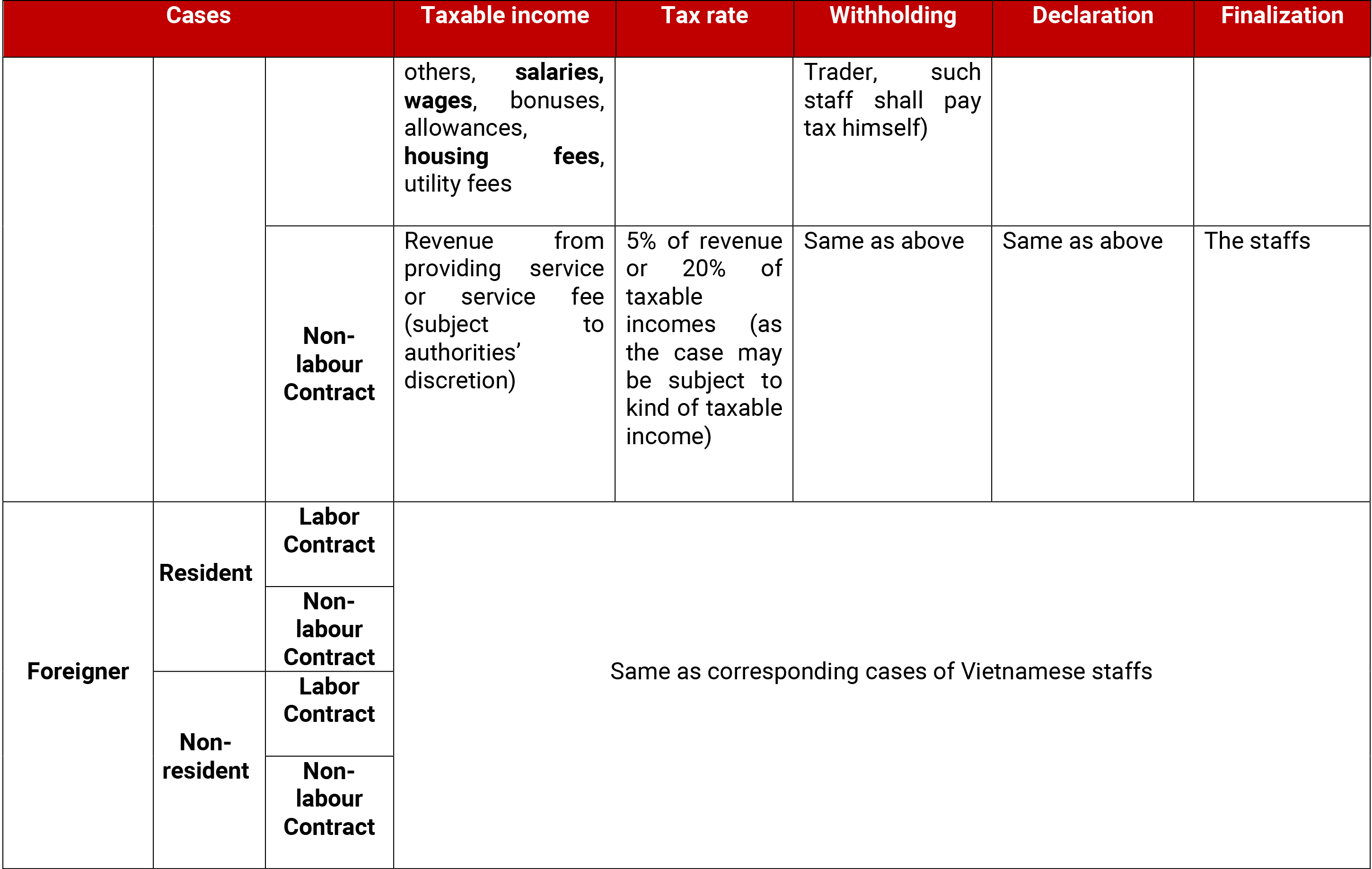

Accordingly, Apolat Legal provides the following comparison table for readers to examine for each specific case. The following table is prepared to distinguish between personal income tax of the Head of a representative office when he is a resident or a non-resident, with labor contract or without labor contract, a Vietnamese or a foreigner.

Notes:

1. The below table is made based on the following assumptions:

- Income is paid for working in Vietnam; and

- Staffs have only one income from RO/Foreign Trader only.

2. Resident means a person who satisfies one of the following conditions:

- Being present in Vietnam for 183 days or more in a calendar year or 12 consecutive months counting from the first date of their presence in Vietnam;

- Having a place of habitual residence in Vietnam, which is a registered place of permanent residence or a rented house for dwelling in Vietnam under a term rent contract.

3. Non-resident means a person who does not satisfy any of the conditions as specified above

Disclaimers:

This article is for general information purposes only and is not intended to provide any legal advice for any particular case. The legal provisions referenced in the content are in effect at the time of publication but may have expired at the time you read the content. We therefore advise that you always consult a professional consultant before applying any content.

For issues related to the content or intellectual property rights of the article, please email cs@apolatlegal.vn.

Apolat Legal is a law firm in Vietnam with experience and capacity to provide consulting services related to Business and Investment and contact our team of lawyers in Vietnam via email info@apolatlegal.com.