2. Provisions of Vietnamese Competition law

2.1. Regulations on controling market concentration (“MC”) under the Law on Competition (“LOC”) 2018

Under the new promulgation in 2018, the LOC acknowledges MC as a “natural right” of Enterprises to contribute and improve the efficiency of its business activies. However, the regulation on controlling MC aims at ensuring that MC will not have or potentially have a negative effect of competitive activities in the market, which protect the effectiveness of the market economy, thereby protect consumer’s interests. In this article, the Author only analyzes the regulations on pre-inspection steps of controlling MC to prevent mergers could potentially deflect market competition – “Notification threshold of MC”. Beside, there are other relevant regulations on post-inspection steps including anti-competitive agreement and abuse of the dominant position as well as sanctions for activities that deflect market competition, including: Appraisal of MC; Decisions on MC; Sanctions and remedies for violations of MC; Handling of competitive cases on MC through competitive proceedings.

2.2 Notification threshold of MC

The notification threshold of MC according to LOC 2018 is determined based on the following criteria: Total assets in Vietnamese market of enterprises taking MC; Total revenue in Vietnamese market of enterprisestaking; Transaction value of MC; The combined market share in the relevant market of enterprises taking MC.

The notification threshold of MC under Decree 35/2020/ND-CP is summarized as in the table below:

| Field | Total assets | Total revenue | Transaction value | Total market share |

| All businesses

(except for Credit Institutions, Insurance companies or Securities companies |

From VND 3,000 billion or more | From VND 3,000 billion or more | From VND 1,000 billion or more | 20% or more in the relevant market |

| Insurance companies | From VND 15,000 billion or more | From VND 10,000 billion or more | From VND 3,000 billion or more | 20% or more in the relevant market |

| Securities companies | From VND 15,000 billion or more | From VND 3,000 billion or more | From VND 3,000 billion or more | 20% or more in the relevant market |

| Credit Institutions | From 20% or more of the total assets of the system of credit institutions in the Vietnamese market | From 20% or more of the total revenue of the system of credit institutions in the Vietnamese market | From 20% of the total charter capital of the system of credit institutions | 20% or more in the relevant market |

MC are divided into the three following groups:

2.2.1 Unrestricted MC

Pursuanto to Clause 1 Article 13 Decree No. 35/2020/ND-CP, MC has total assets/ revenue sold or purchased in Vietnamese market of an enterprise or a group of affiliated enterprises of which the enterprise is a member is less than VND 3,000 billion in the fiscal year adjacent to the expected year of implementation of MC; transaction value of less than VND 1,000 billion; enterprises intend to participate in MC with a combined market share of less than 20% in the relevant market in the fiscal year adjacent to the expected year of implementation of MC, are not prohibited and not obliged to carry out procedures of MC notification to the National Competition Commision.

In practice, the above notification threshold exposed inadequacy and minimize unrestricted MC. For instance, an enterprise participates in a trade association, whose total assets reach VND 3,000 billion or more in the fiscal year adjacent to the expected year of implementation of MC, must notify the National Competition Commission if intends to perform any MC activities, whether the value of such transaction is worth VND 1,000 or VND 01 billion, or the value of its combined market share is 20% or 01%. Thus, although there are cases where the market share in the relevant market of enterprises participating in transactions is negligible, there is almost no possibility of acquisition or the risk of causing market disruption but still subject to mandatory notification of MC. The complication of the notification procedure along with the processing time for preliminary appraisal of the notification dossier and confirmation of approval to conduct the MC transactions is quite long (30 days), prolonged execution time will also create concerns for businesses intending to carry out MC transaction, especially those intend to expand investment into new industries and fields.

2.2.2 Restricted MC

MC which has total assets / total revenues in the Vietnamese market of business entities or trade association of which its member reaches from 3,000 billion or higher in the fiscal year adjacent to the expected year of implementation of MC; total transaction value from VND 1,000 billion; for enterprises intend to participate in MC has a combined market share of 20% or more in the relevant market in the fiscal year adjacent to the expected year of implementation of MC are cases requiring approval of MC, and are obliged to notify the National Competition Comission.

Accordingly, the National Competition Comission will assess the MC based on market share, the level of concentration in the relevant market before and after the MC, the relationship of enterprises taking in MC, thereby giving a general assessment, and deciding on the MC development on the basis of its positive impact and potential to restrict competition.

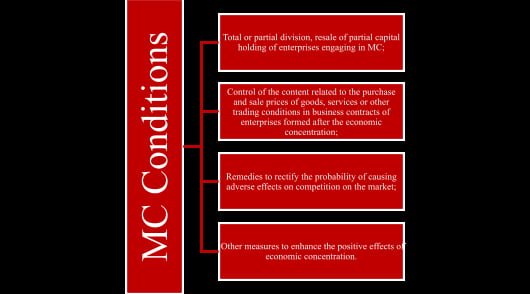

In the event of acceptance, the parties may be subject to the post-inspection conditions, also known as conditional MC. The conditions applicable to MC transactions including:

2.2.3 Prohibited MC

As mentioned above, Vietnamese competition law acknowledges that MC is a legal right of enterprises. However, when considering the negative side of competition, the state provides a legal framework for MC behaviors which impact or has the potential of significant impact on anti-competition in the market, or in other words, diminishing the “perfection” of competitive market.

To assess the effect or the potential of significantly effect on anti-competition, the authorities will base on the following criterias: Combined market share of enterprises taking MC in the relevant market; Level of concentration in the relevant market before and after MC; The relationship of enterprises taking MC in the production, distribution and supply chain for a certain type of goods, services or business sectors of enterprises taking MC is the input of each other or complement each other; Competitive advantage from MC in the relevant market; The ability of enterprises after MC to increase prices or increase the profit-to-revenue ratio significantly; The ability of enterprises after MC to eliminate or prevent other enterprises from entering or expanding the market; Specific factors in the industry and sectors in which enterprises taking MC do business.

After the MC is preliminary assessed, if MC is subject to official appraisal as prescribed in Clause 4 Article 14 of Decree No. 35/2020/ND-CP, enterprises must submit dossiers for official appraisal procedures. After the official appraisal of the MC, the National Competition Comission issued a decision on: (i) Whether or not MC is prohibited as prescribed in Article 30 of the LOC; (ii) Providing additional conditions and procedures before the enterprise enter MC to ensure a competitive environment in the field of such MC.

In conclusion, to add specific criterias to determine the notification threshold as analyzed above helps bringing more accurate screening for cases where MC has the potential to negatively impact on the market competition. Additionally, this also increases the proactiveness of enterprises in self-assessment and implementation of procedures to notify state agencies as well as giving state agencies the right to assess the competitive impact of MC.

If you have any questions or require any additional information, please contact Apolat Legal – An International Law Firm in Viet Nam.

This article is for general information only and is not a substitute for legal advice.