In the context of the development of the digital era, high-tech enterprises are always at the forefront of the integration process and bring in large revenues to contribute to the national budget. However, being granted a Certificate of High-tech Business Registration in Vietnam is not an easy thing because there are many criteria that businesses need to meet. The following article will provide an overview of conditions and procedures for issuance of hi-tech enterprise registration certificates in Vietnam, thereby providing businesses and investors with important information in adjusting and developing strategies for enterprises.

1. Conditions for determining a high-tech enterprise

To become a high-tech enterprise, enterprises need to meet the following criteria:

Firstly, enterprises must produce hi-tech products on the list of hi-tech products encouraged for development. Accordingly, hi-tech products encouraged for development are hi-tech products created from technologies on the List and satisfy the following conditions:

- Having a high proportion of added value in the product value structure;

- Having high competitiveness and great socio-economic efficiency;

- Having high capability for export or substitution of imported products;

- Contributing to improving national scientific and technological capacity.

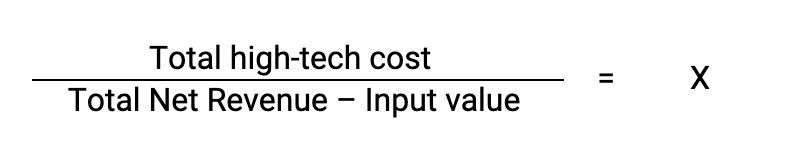

Secondly, the average total expenditure of enterprises in 3 consecutive years for research and development activities carried out in Vietnam must reach at least 1% of total annual revenue, from the fourth year onwards must reach more than 1% of total revenue. The formula for determining the ratio is specified in Clause 2 Article 3 of Decision 10/2021/QD-TTg as follows:

Whereas:

- Total expenditure on research and development activities of enterprises includes:

-

- Depreciation of investment in infrastructure, fixed assets, annual recurrent Fee on research and development activities;

-

- Fee on training and training support activities for research and development workers of enterprises, scientific and technological organizations, training institutions in Vietnam;

-

- Fees for copyrights, transfer of ownership rights, right to use industrial property objects for research and development activities;

-

- Fees for patent recognition or protection of inventions or useful solutions in Vietnam.

- Input value includes: Value of raw materials and components for production, import and annual domestic purchases.

- The X ratio must correspond as follows:

-

- For enterprises with a total capital of VND 6,000 billion and a total number of employees of 3,000 people or more: X >= 0.5%;

-

- For enterprises not falling under case (i), with a total capital of VND 100 billion and a total number of employees of 200 people or more: X >= 1%;

-

- For enterprises not falling under cases (i) and (ii) above: X >= 2%.

Third, the average revenue of enterprises in 3 consecutive years from hi-tech products must reach at least 60% of the total annual turnover, from the fourth year onwards must reach 70% or more;

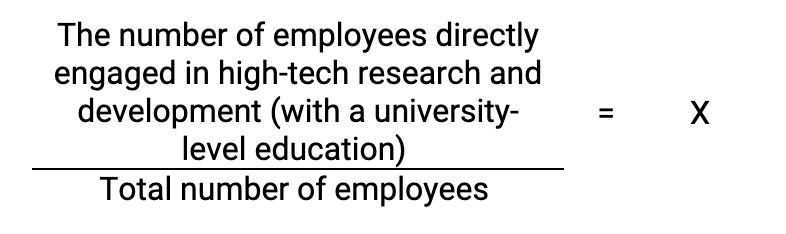

Fourth, the number of employees of enterprises with professional degrees from university or higher directly conducting research and development must reach at least 5% of the total number of employees. The formula for determining the proportions is as follows:

Whereas:

- The number of employees directly involved in CNC research and development must meet the following conditions:

-

- Having a vocational college degree or higher;

- Having a labor contract with a duration of at least 1 year or an indefinite-term contract.

Note: The proportion of employees with vocational college degrees must not exceed 30%.

- The Y ratio should correspond as follows:

-

- For enterprises with a total capital of VND 6,000 billion and a total number of employees of 3,000 people or more: Y >= 1%;

-

- For enterprises other than case (i), with a total capital of VND 100 billion and a total number of employees of 200 people or more: Y >= 2.5%;

-

- For enterprises other than (i) and (ii) above: Y >= 5%.

2. Procedures for applying for a hi-tech enterprise registration certificate

Step 1: Prepare 01 original dossier and 01 photo dossier

Components of an application for a hi-tech enterprise registration certificate include:

- An application for recognition of a hi-tech enterprise according to the form prescribed by the Ministry of Science and Technology;

- Notarized copy of Business Registration Certificate or Investment Certificate or Certificate of Science and Technology Enterprise;

- An explanation that the enterprise has fully met the conditions specified in Clause 1, Article 18 of the Law on High Technology;

- Supporting documents of research and development activities carried out in Vietnam;

- Financial statements of the enterprise (certified by audit) (Note: must be an enterprise operating for at least 01 year);

- Dissection reports on the cost of conducting research and development activities and revenue from high-tech products;

- Records of the workforce engaged in research and development activities (list and diplomas);

- Records of the quality management system;

- Dossiers of product quality standards applied by the enterprise;

- Dossier Explanation for compliance with standards and technical regulations on environment and energy saving.

Step 2: Apply in person or by post or through the National Public Service Portal

Step 3: The Ministry of Science and Technology collects opinions of relevant ministries and People’s Committees

If the dossier is incomplete, the Ministry of Science and Technology must issue a letter requesting supplementation and completion of the dossier to be sent directly or by post to the enterprise applying for recognition of a hi-tech enterprise. Within 10 working days from the date of receipt of the request letter from the Ministry of Science and Technology, the enterprise applying for the Certificate of Hi-tech Enterprise shall supplement, repair and send it back to the Ministry of Science and Technology.

In case of necessity, the Ministry of Science and Technology shall organize meetings with concerned ministries, sectors and People’s Committees of provinces and centrally-run cities to clarify issues mentioned in the dossier of application for recognition of hi-tech enterprises.

Step 4: Appraisal and issuance of hi-tech enterprise certificate

Within 30 days from the date of receipt of complete dossiers, the Ministry of Science and Technology shall appraise and grant hi-tech enterprise certificates and send them to enterprises. In case of refusal to grant a hi-tech enterprise certificate, it must notify the reason in writing to the enterprise applying for recognition of a hi-tech enterprise.

Disclaimers:

This article is for general information purposes only and is not intended to provide any legal advice for any particular case. The legal provisions referenced in the content are in effect at the time of publication but may have expired at the time you read the content. We therefore advise that you always consult a professional consultant before applying any content.

For issues related to the content or intellectual property rights of the article, please email cs@apolatlegal.vn.

Apolat Legal is a law firm in Vietnam with experience and capacity to provide consulting services related to Business and Investment and contact our team of lawyers in Vietnam via email info@apolatlegal.com.