Currently, with the policy of opening the market to attract FDI capital flows, Vietnam is a market targeted by foreign investors to establish investment projects. However, before implementing an investment project in Vietnam, foreign investors in the cases required to apply for an Investment Registration Certificate (“IRC“) according to the provisions of the Investment Law 2020 must complete this procedure and note related issues that arise during the process of applying for an IRC as follows:

1. Cases in which foreign investors must apply for an IRC but are not subject to investment policy approval

According to Clause 1 of Article 37 of the Law on Investment 2020, cases requiring the IRC issuance procedure include:

- Investment projects of foreign investors.

- Investment projects of economic organizations as specified in Clause 1 of Article 23 of the Investment Law 2020.

A foreign investor, according to Clause 19 of Article 3 of the Law on Investment 2020, is an individual with foreign nationality or an organization established under foreign law that conducts investment and business activities in Vietnam. For instance, an individual with Singaporean nationality planning to establish a company in Vietnam or a company established and operating legally in Hong Kong planning to establish a company in Vietnam are both considered foreign investors.

According to Clause 1 of Article 23 of the Law on Investment 2020, investment projects of economic organizations in the following cases must carry out procedures to apply for an IRC:

- Having foreign investors hold more than 50% of the charter capital or have a majority of general partners who are foreign individuals in the case of economic organizations that are general partnerships.

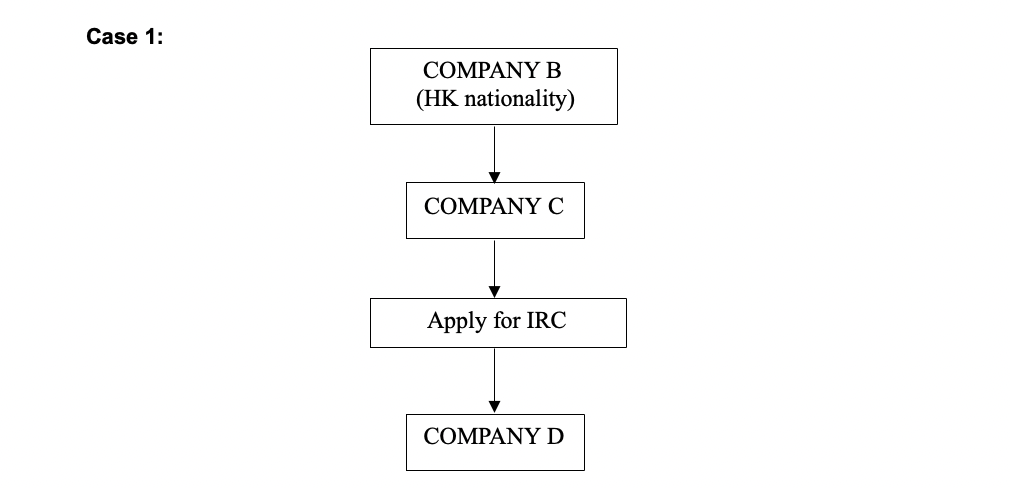

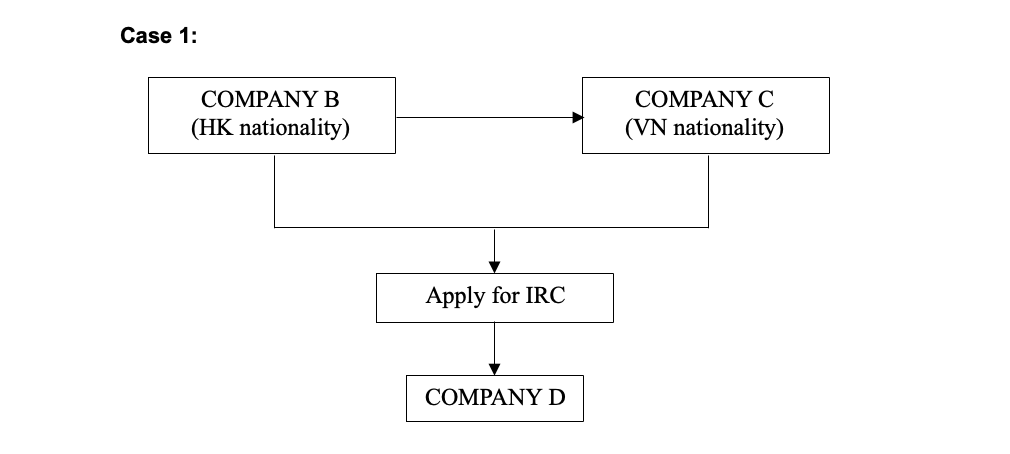

For example, if Company B, which is lawfully established and operating in Hong Kong, intends to establish another Company C in Vietnam, and Company C further establishes Company D, then Company C must complete the IRC application procedure. However, if Company C is established with a foreign investor ownership ratio of less than 50%, the IRC application procedure is not required.

- Having an economic organization mentioned above that holds more than 50% of the charter capital.

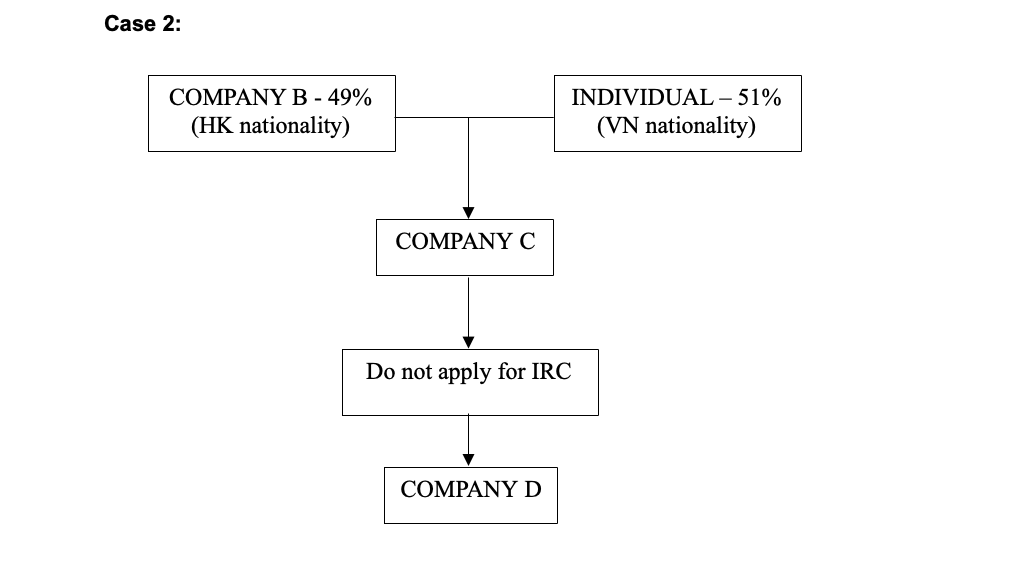

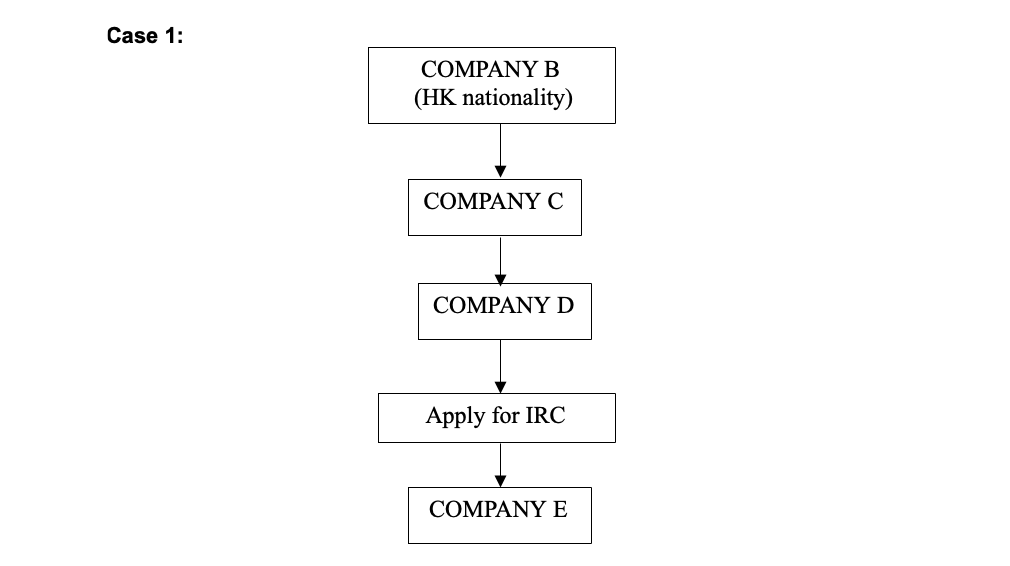

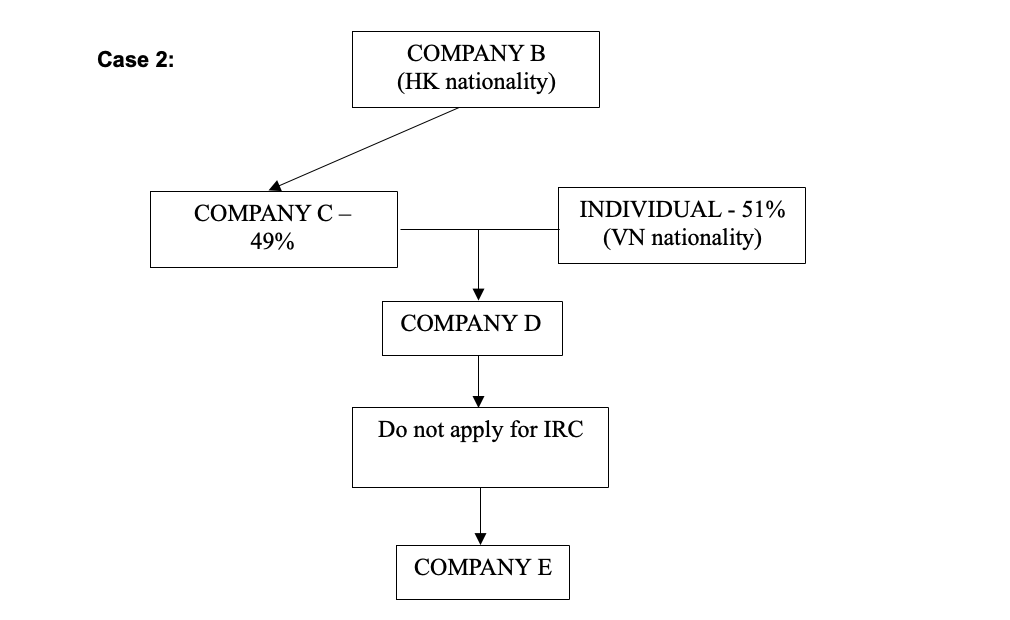

For example, Company B, which is legally established and operating in Hong Kong, intends to establish Company C in Vietnam. Company C then goes on to establish Company D in Vietnam. Subsequently, Company D establishes Company E in Vietnam. In this case, Company D’s project is required to undergo the IRC application procedure. However, if there is a change such that Company C, together with a Vietnamese individual, establishes Company D with Company C’s ownership ratio of 49% and the Vietnamese individual’s ownership ratio of 51%, then Company D’s project will not be required to undergo the IRC application procedure.

- Having both foreign investors and economic organizations specified in Point a, Clause 1, Article 23 of the Investment Law 2020 holding more than 50% of charter capital.

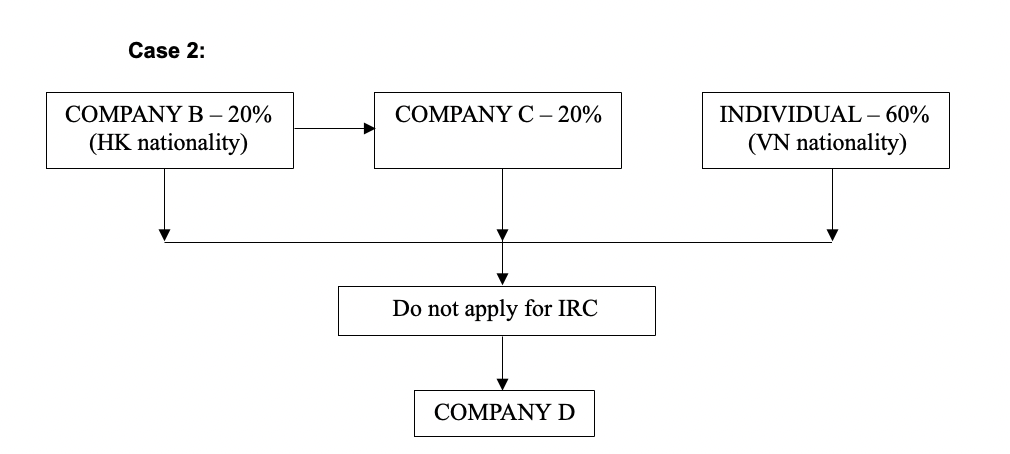

For example: when Company B, a Hong Kong national, intends to establish Company C in Vietnam, and then both companies jointly establish Company D in Vietnam. In this case, Companies B and C’s projects must undergo the IRC application procedure. Nevertheless if Company B, Company C, and a Vietnamese individual continue to establish Company D with ownership ratios of 20% for Company B, 20% for Company C, and 60% for the Vietnamese individual, then the projects of Company B, Company C, and the Vietnamese individual will not need to undergo the IRC application procedure.

2. Related issues arising during the process of applying for an IRC

a. The nationality of Investors:

In accordance with Clause 7 of Article 17 of Decree 31/2021/ND-CP, foreign investors from countries or territories that are not WTO members will be applied the same market access conditions as investors from WTO member countries when investing in Vietnam, unless Vietnamese law or international treaties between Vietnam and that country or territory provide otherwise. Therefore, if foreign investors from non-WTO member countries such as British Virgin Islands or Cayman Islands, their market access conditions also apply similarly to the market access conditions of foreign investors come from countries that are WTO members.

b. The principles applicable to market access restrictions:

According to Article 17 of Decree 31/2021/ND-CP, the principles applicable to market access restrictions are clearly defined as follows:

- For sectors not included in Appendix I of Decree 31/2021/ND-CP, foreign investors will have market access according to the regulations for domestic investors, regardless of nationality, charter capital ownership ratio, and similar factors.

- For sectors and industries that have not yet been granted market access as specified in Section A of Appendix I of Decree 31/2021/ND-CP, foreign investors are not allowed to invest.

- For sectors and industries with conditional market access as specified in Section B of Appendix I of Decree 31/2021/NĐ-CP, foreign investors must meet the market access conditions specified therein.

c. The location of investment project implementation:

For projects implemented in Ho Chi Minh City, investors can check whether any investment projects have been granted at that location by accessing the website https://doanhnghiep.hochiminhcity.gov.vn/ to search.

Disclaimers:

This article is for general information purposes only and is not intended to provide any legal advice for any particular case. The legal provisions referenced in the content are in effect at the time of publication but may have expired at the time you read the content. We therefore advise that you always consult a professional consultant before applying any content.

For issues related to the content or intellectual property rights of the article, please email cs@apolatlegal.vn.

Apolat Legal is a law firm in Vietnam with experience and capacity to provide consulting services related to Business and Investment and contact our team of lawyers in Vietnam via email info@apolatlegal.com.