Vietnam is increasingly becoming an attractive destination not only for Foreigners seeking employment and tourism but also an ideal choice for those looking for investment opportunities and long-term residence. Among various options, buying resale condominium apartments from another individual or organization is becoming a popular trend, thanks to the convenience it offers; Foreigners can quickly take handover and use the apartment without long waits. However, owning a resale condominium apartment in Vietnam requires a thorough understanding of the legal regulations and related procedures. This article will provide some key considerations for foreigners wishing to purchase a condominium apartment in Vietnam, helping parties prepare better for the transaction and avoid unnecessary risks.

See more: Legal basis and procedures for buying residential houses in Vietnam for foreigners

1. Type of Resale Condominium Apartments that Foreigners are permitted to buy

A Resale Condominium Apartment (also known as secondary real estate) refers to an apartment that was previously owned by an individual, organization, or investor who had originally purchased it from the Project Developer. The characteristic of Resale Condominium Apartments is that these assets are used, not newly built products or properties that have never been owned before.

Article 19.1 of the Law on Housing 2023 prescribes that Foreigners may only purchase, lease-purchase, receive as a gift, inherit, and own no more than 30% of the total number of apartments within a single condominium building. Accordingly, Foreigners can buy Primary Condominium Apartments directly from the Project Developer or Resale Condominium Apartments from other foreign individuals or organizations. Purchasing, lease-purchasing, or receiving an apartment as a gift from a Vietnamese individual or organization is practically infeasible, as state agencies have not yet established a control mechanism to ensure compliance with the 30% ownership limit.

2. Signing a deposit agreement and making a deposit to secure the transaction

In an apartment sale transaction, making a deposit is a crucial step that helps ensure commitment between the parties and facilitates a smooth transaction process. The deposit is the amount paid by the Buyer to the Seller to confirm the intention to purchase and commit to executing the transaction as agreed. The deposit amount typically ranges from 5% to 10% of the sale contract value, although this percentage may vary based on mutual agreement between the parties.

The main purpose of the deposit is to protect the interests of both parties and avoid situations where one party changes their mind or fails to fulfill their commitments. For the Buyer, the deposit ensures that the Seller will not sell the apartment to another party during the agreed period. For the Seller, receiving the deposit confirms the Buyer’s seriousness and facilitates subsequent legal procedures. If the Buyer fails to fulfill their commitments as agreed, the deposit may be forfeited. Conversely, if the Seller breaches the agreement, they typically must refund double the deposit amount received from the Buyer. Therefore, carefully negotiating and clearly stating the terms in the Deposit Agreement is crucial to protect the legitimate rights of both parties.

3. Document preparation and notarization of the transfer contract

According to legal regulations, real estate transfer contracts between individuals or organizations not engaged in the real estate business must be notarized at a competent Notary Office. This notarization ensures the legal validity of the transaction and helps prevent disputes arising subsequently. The Parties need to prepare documents similar to other real estate transactions, such as the Certificate of Land Use Rights and Ownership of House and Other Assets Attached to Land (commonly known as the “Pink Book”), Passports, etc.

In case where the apartment has not yet been issued a Pink Book, and the Seller has only signed an Apartment Transfer Contract (often the Primary Apartment Purchase Agreement) with the Project Developer, the transfer of the apartment requires the approval and support of the Project Developer before the transfer contract can be notarized. This involves the Project Developer confirming the validity of the transaction, updating the new buyer’s information in the project file, and assisting with necessary administrative procedures to ensure the Buyer’s rights. Parties should note that the transfer transaction is only considered complete upon full compliance with the procedures prescribed by the Project Developer and relevant state agencies. Non-compliance can lead to legal risks, such as the transaction not being officially recognized or the Buyer being unable to obtain the Pink Book later.

Typically, the Transfer Contract will be drafted based on a template provided by the Notary Office. The terms of this contract are often difficult to change because amendments require not only the agreement of the Buyer and Seller but also the consent of the Notary Public.

4. Taxes, charges, and fees

When conducting an apartment transfer transaction, the involved parties must pay the following taxes, charges, and fees as required by Vietnamese law and common practice:

(i) Personal Income Tax (PIT): Typically, the Seller is liable for PIT arising from the apartment transfer. The tax rate is 2% of the transfer price stated in the contract or the price prescribed by the State (if the contract price is lower than the state-regulated price), whichever is higher.

(ii) Registration fee: Typically, the Buyer is liable for the registration fee upon registering ownership of the apartment. The fee rate is 0.5% of the apartment’s value (based on the official land price framework or the transfer value, whichever is higher).

(iii) Notarization charge for the transfer contract: Responsibility for payment is subject to agreement between the parties, but often the Seller pays. The charge is calculated based on the value of the transferred apartment and can range from several hundred thousand VND to tens of millions VND.

(iv) Brokerage service cost: If the transaction involves a broker, this cost is subject to agreement between the parties, typically ranging from 1% to 2% of the transfer value and usually paid by the Seller.

The parties should clearly agree on the responsibility for paying these taxes, fees, and charges within the transfer contract to avoid future disputes. Tax declaration and payment must be completed on time to avoid administrative penalties; it is recommended that parties proceed with this immediately after signing the Transfer Contract at the Notary Office.

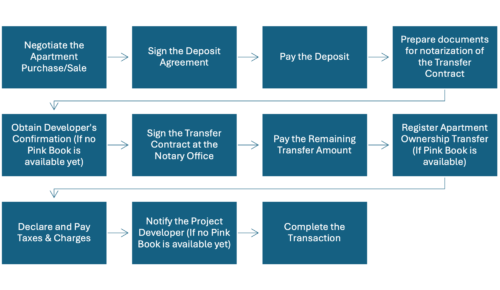

5. Common Steps for Conducting an Apartment Transfer

Disclaimers:

This article is for general information purposes only and is not intended to provide any legal advice for any particular case. The legal provisions referenced in the content are in effect at the time of publication but may have expired at the time you read the content. We therefore advise that you always consult a professional consultant before applying any content.

For issues related to the content or intellectual property rights of the article, please email cs@apolatlegal.vn.

Apolat Legal is a law firm in Vietnam with experience and capacity to provide consulting services related to Real Estate and contact our team of lawyers in Vietnam via email info@apolatlegal.com.