Insights

Legal Updates

Vietnam passes law on digital technology industry

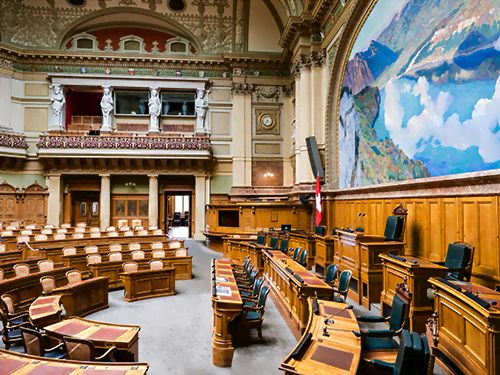

On June 14th, 2025, at its 9th Session, 15th Legislature, the Vietnamese National Assembly passed

Announcement of electronic identification for foreigners at the immigration office of HCMC

According to Decree No.69/2024/ND-CP dated June 25th, 2024 issued by the Government on electronic identification and authentication, Apolat Legal hereby respectfully informs our Clients of the procedures for foreigners to

Regulations on tax administration for households and individuals doing business on e-commerce platforms

The Government of Vietnam issued Decree No. 117/2025/ND-CP (“Decree 117”) on June 9, 2025, stipulating tax administration for business activities of households and individuals on e-commerce platforms and digital platforms.

Announcement Of electronic identification for agencies, organizations

Pursuant to Decree No. 69/2024/ND-CP of the Government dated June 25th, 2024, on electronic identification and authentication, Apolat Legal sincerely informs our Valued Clients of the implementation of electronic identification

Important notes for businesses when state agencies rearrange administrative units

On November 14th, 2024, the National Assembly Standing Committee approved Resolution No. 1278/NQ-UBTVQH15 on the

Proposal for Licensing and operations of microfinance institutions

1. Proposal for Licensing and operations of microfinance institution The State Bank of Vietnam is

The Ministry of Public Security proposes the development of a Law on Personal Data Protection

1. Draft Decree on the controlled sandbox mechanism for financial technology (Fintech) activities The draft

Revocation of Certificate of Food Safety Compliance for Establishments

1. The Ministry of Information and Communications is drafting a Decree on electronic signatures and

Finalising the legal framework for virtual assets and virtual asset service providers by May 2025

The Government has just issued a National Action Plan with 17 specific actions to implement

Officially impose global minimum tax from fiscal year 2024

1. Officially impose global minimum tax from fiscal year 2024 The National Assembly passed Resolution

Find out how we can help your business